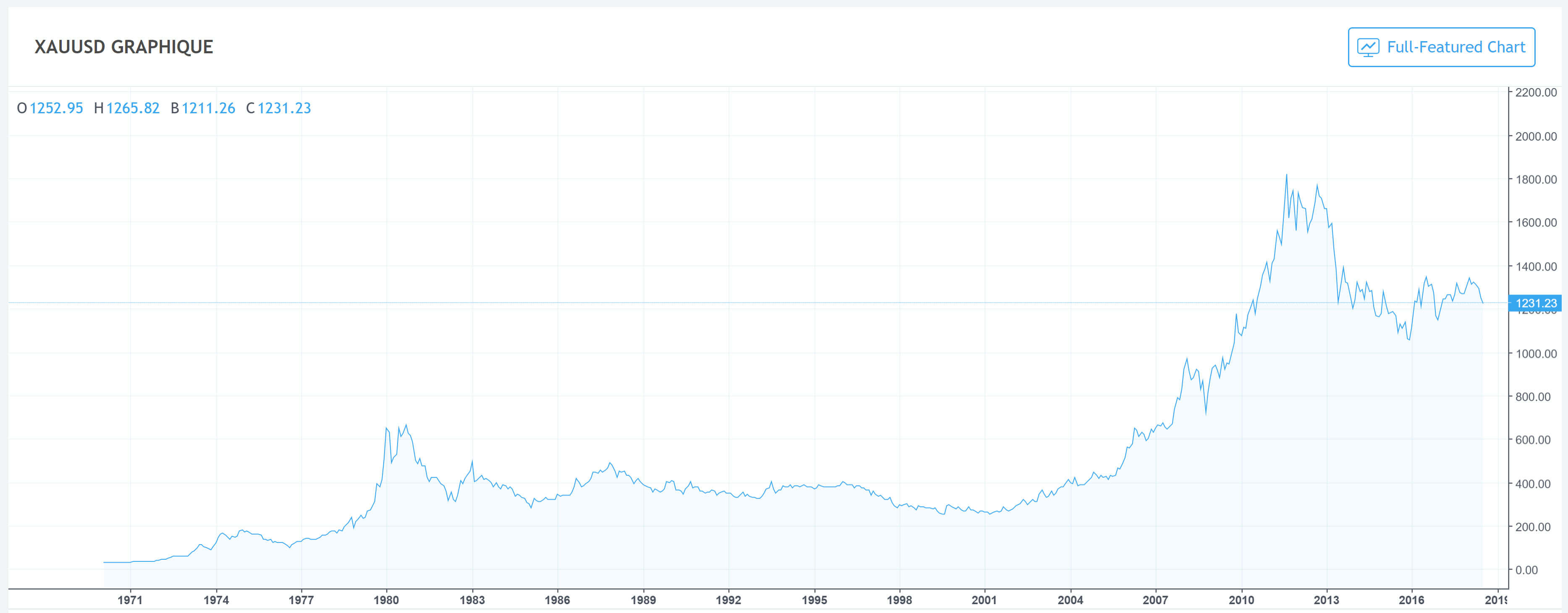

Gold Value in Bullrun: 2000 to 2011

Before Bitcoin there was Gold which between the year 2000 and the year

2011 went from $ 250 an ounce to $ 1800. This meteoric rise of 620% in

11 years is 56% increase per year. This rise in the price of an ounce of

gold was partly caused by the financial crisis of 2007 as can be seen in

the graph below. This gold chart is available on the tradingview site

[1].

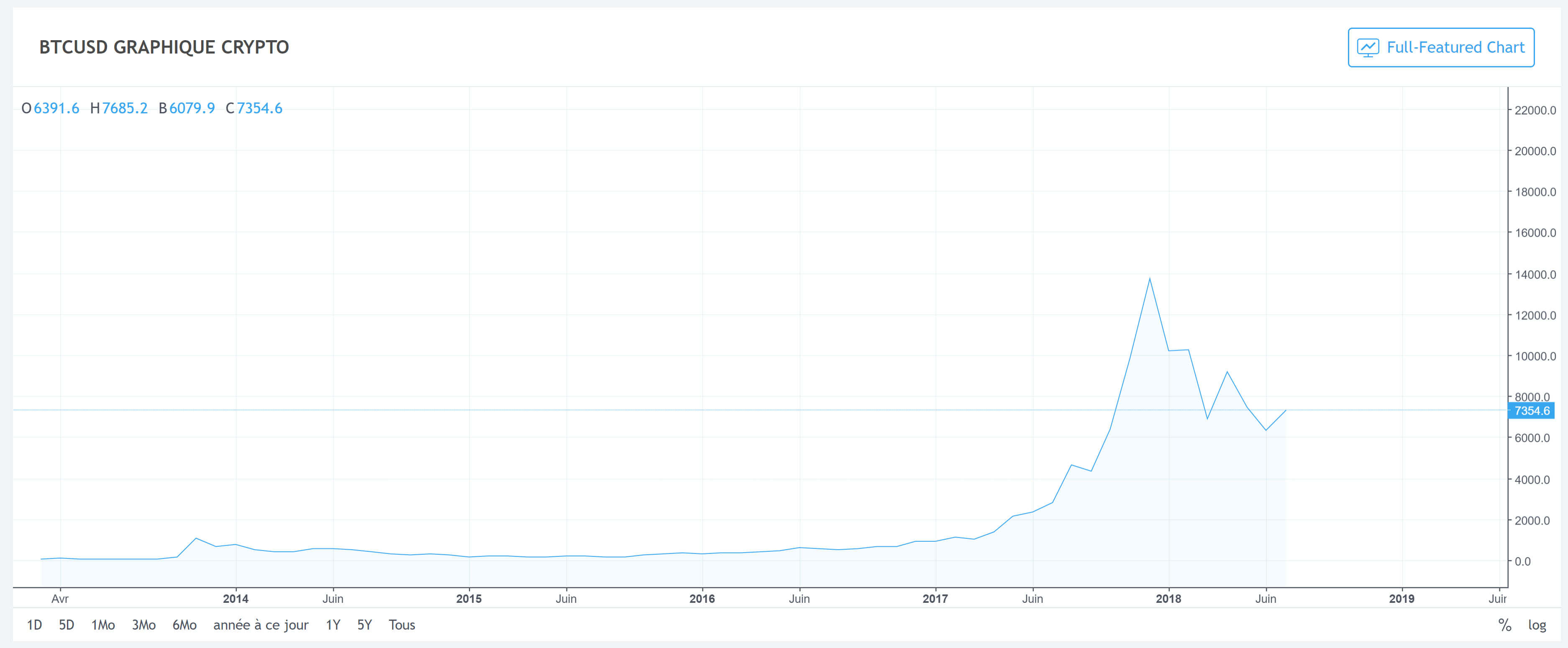

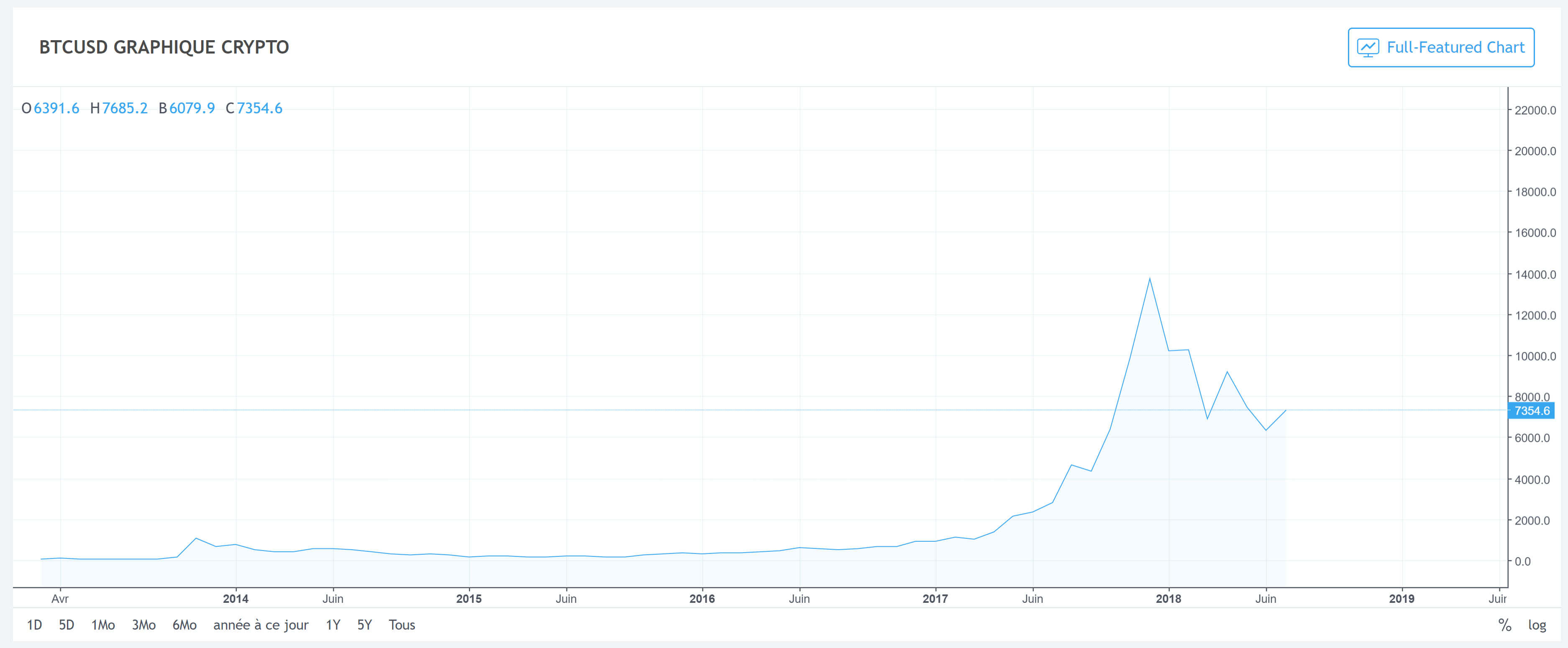

Bitcoin Value in Bullrun: 2010 to 2017

It was at this very moment, shortly after the 2007 financial crisis,

that an unknown inventor introduced himself under the pseudonym of

Satoshi Nakamoto published the white paper [2] on the new digital

currency called Bitcoin (BTC) which became famous with this ₿ associated

with the two vertical bars of the dollar. For the first time the

principle of the blockchain is used to store value and exchange it with

other people. The first generation blockchain was born. It is based on

the proof of work (POW) which makes it polluting because it consumes a

lot of energy to verify transactions. It is between 2009 and 2011 that

Bitcoin began to be known to the most geeks of computer scientists. At

this moment you had to have some computer skills to get started, we'll

say that nothing was done to the general public. Between 2011 and 2018

the Bitcoin rose from $ 1 per unit to $ 19,000 per unit at the end of

2017. This rise more than exceptional made early adopters more than

rich, this represents an increase of 1,900,000% in 7 years an increase

of 271,000% per year.

By investing $ 100 in 2011 you could have obtained $ 1,900,000 at the

end of 2017, of course it is very difficult to buy and sell at the

lowest, but it is to give you an idea of the earning potential of a

savvy investor!

This Bitcoin graph is available on the tradingview

site (BTC / USD) [3]

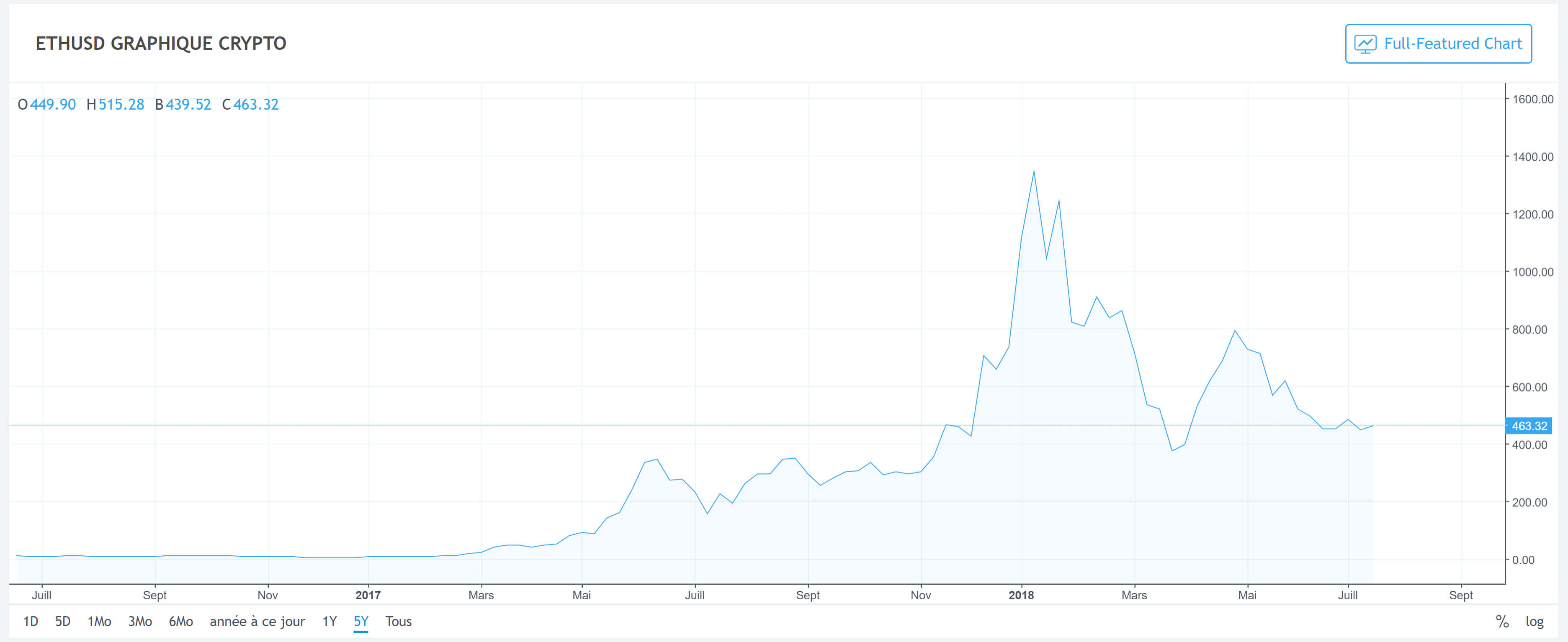

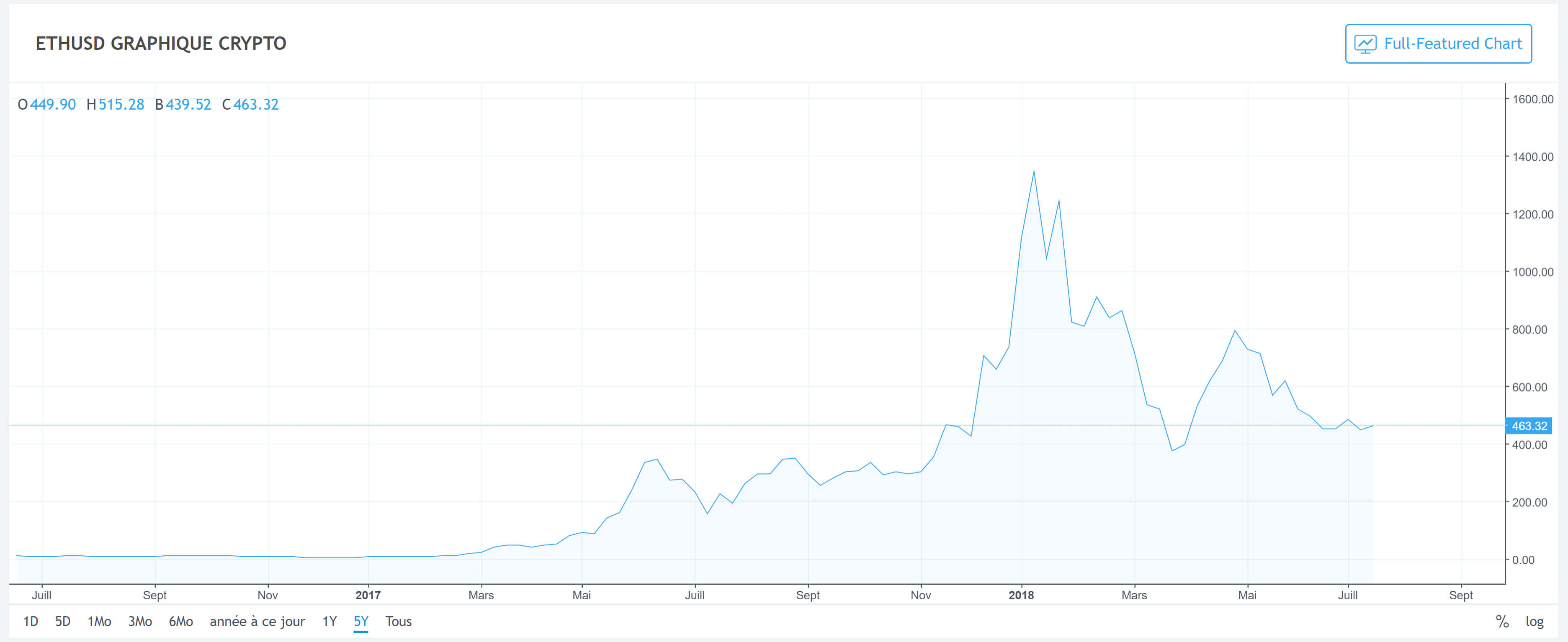

Ethereum Value in Bullrun: 2015 to 2018

It was in 2014 that computer scientists working on Bitcoin came up with

the idea of creating a new digital currency: Ethereum (ETH), more

powerful and more ambitious than Bitcoin. Ethereum is the second

generation blockchain, it is created by Vitalik Buterin, Anthony Diiorio

and Charles Hoskinson to name only the best known because quickly the

community is enlarged and there are now more than 300 people working on

this project. Like Bitcoin it is based on proof of work (POW) but the

team later moved towards proof of stake (POS) Between

2015 and 2018 Ethereum increased from $ 1 per unit to $ 1389 at the

beginning of the year 2018, an increase of 138,900 % in 3 years which

corresponds to 46 300% per year. The Ethereum has been controversial for

a few weeks because it is young and it is experiencing difficulties such

as the number of transactions per second far too low currently,

Transaction costs are high for some use cases. These two problems can

potentially be solved by switching to the Proof of Interest (POS) For

more information look at the Tetras Capital Investment Fund article

which explains in detail: Ethereum the downside thesis [4] This Ethereum

graph is available on the tradingview site (ETHUSD) [5]

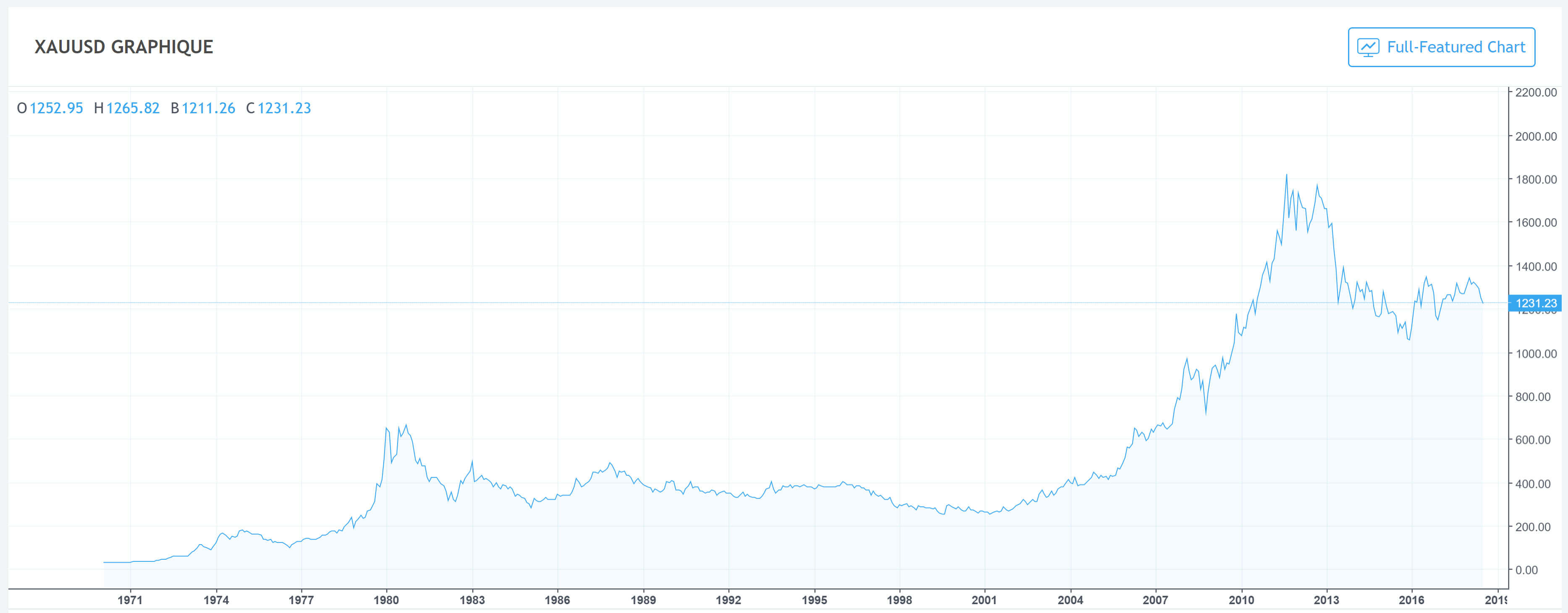

Buy the next Cryptocurrency?

Now that these three assets have seen significant increases, it is

certain that the biggest increase is past, in fact it is more difficult

to obtain a gain of 1000% or 10 000% on an asset valued $ 1200 for Gold,

7400 $ for Bitcoin or $ 150 for Ethereum. That's why the smartest are

looking for what will be the next active to explode upward. What will be

the third generation blockchain? Whats is coming after the blockchain ?

For that you have to do research, try and analyze. And the task is not

easy, there are now more and more cryptocurrencies that are created and

it does not make it easy. Of course a cautious investor can always bet

on Gold and Bitcoin that are considered safe assets to store value, see

SOV [6]